|

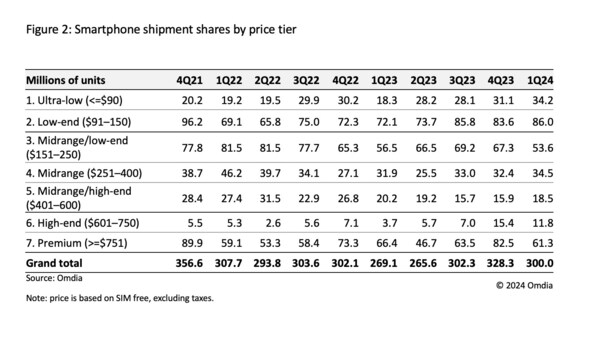

LONDON, June 17, 2024 /PRNewswire/ -- According to the latest Omdia Smartphone Model Market Tracker, the low-end price segment experienced the fastest growth among all smartphone categories. Phones priced under $150 grew by 30 million year-on-year, from 90 million in 1Q23 to 120 million in 1Q24, marking a 33% growth. Notably, the ultra-low-cost phones priced at $90 or less, demonstrated an impressive 87% year-on-year growth rising from 18 million in 1Q23 to 34 million in 1Q24.

A significant factor driving this growth is the trend among mid-end phone buyers: to either upgrade their new phone to higher-end models or downgrade to more affordable low-end phones. According to Omdia's consumer survey, the smartphone replacement cycle in emerging markets is shorter compared to developed countries. "This is due to the poor performance and shorter security and OS support period of cheap smartphones," explained Aaron West, Senior Analyst in Omdia's Smartphone group. The expanding emerging markets are also steadily increasing the demand for low-end smartphones, as OEMs launch new low-priced models in countries such as India.

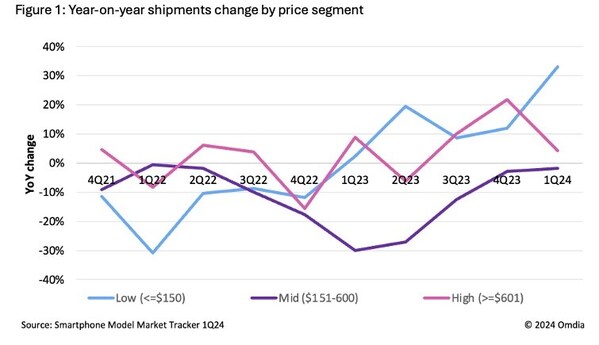

The demand for mid-end phones, priced between $151 and $600, experienced a significant decline in early 2023 and has not yet recovered. In 1Q24, these phones accounted for 107 million shipments, down 2 million from 109 million in 1Q23. As illustrated in Figure 1, this long-term trend shows a negative year-on-year (YoY) change in the mid-end segment in recent years, while the low-end segment has seen positive growth since 1Q23 and the high-end segment since 3Q23.

The high-end segment, including phones priced above $600, has also experienced growth YoY. In 1Q24, this segment saw an increase of 3-million-unit compared to 1Q23, rising from 70 million to 73 million. This growth is evident with the new Samsung Galaxy S24 series, which totaled 14.3 million shipments in 1Q24, following its launch on 24 January 2024. This is an improvement over last year's S23 series, which shipped 11.8 million units in 1Q23.

The Samsung Galaxy S24 Ultra saw a 30% increase in shipments compared to the S23 Ultra in 1Q23. This growth is attributed to the rising demand for premium phones growing, particularly top-of-the-range models. A prominent example of this is the iPhone 15 Pro Max, which emerged as the most popular phone of 1Q24, with 11.5 million shipments. This trend indicates that more consumers are opting for the Pro or Ultra versions of new releases over the baseline iPhone 15 and Samsung Galaxy S24 phone models.

All this points to an increasingly divided smartphone market between low-end consumers, primarily in emerging markets and premium smartphone consumers in developed markets.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Fasiha Khan Fasiha.khan@omdia.com

source: Omdia

【你點睇】港鐵失倫敦伊利沙伯線專營權,你認為「國際化」遇挫的港鐵應否將重心轉移回本地?► 立即投票