|

MANILA, Philippines, Aug. 6, 2024 /PRNewswire/ -- Brankas and Boost Capital have launched LoanLink, the first chat-based lending solution of its kind in Southeast Asia. LoanLink provides a user-friendly chat interface that facilitates seamless integration and instant loan applications. By eliminating manual processes, complex integrations, and incomplete applications, this digital-first approach enhances efficiency and reduces operational expenses.

LoanLink offers a fully-digital loan application channel to traditional companies, banks, fintechs, and financial institutions. Organizations can now provide a loan process that is both accessible and seamless by utilizing chat-based interactions. This enables customers to access loans from any location and at any time. By providing a convenient and efficient method of loan application, this guarantees a broader market reach beyond physical branches

"We are excited to launch LoanLink, a solution that sets a new standard for digital lending," stated Todd Schweitzer, CEO of Brankas. "Fintechs and businesses that want to enter the lending space can now easily do so by leveraging this out-of-the-box platform. This helps to level the playing field, giving borrowers the power to pick the lender with the best UX and rates."

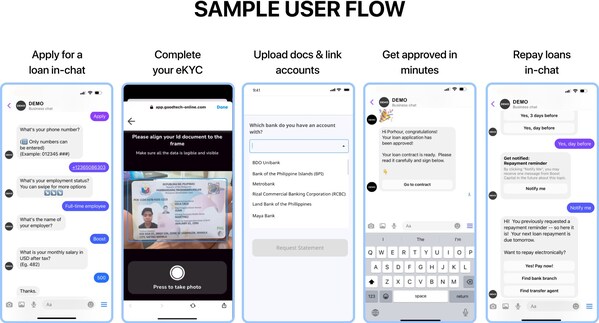

Here's how it works: applicants start by applying via chat, complete eKYC, upload necessary documents, and link their accounts. Within minutes, they receive approval and can manage repayments through the same chat interface. This streamlined process not only improves borrower satisfaction but also boosts operational efficiency, making LoanLink a game-changer in the lending industry.

LoanLink leverages the combined expertise of Brankas and Boost Capital. Brankas provides advanced open banking APIs that ensure secure and compliant integrations with financial institutions, while Boost Capital offers a white-labeled tech platform that enables banks to onboard customers through popular chat platforms such as Facebook Messenger, Telegram, and WhatsApp. Together, they deliver a comprehensive solution that enhances the borrower experience and operational agility.

Gordon Peters, CEO of Boost Capital, commented, "This partnership is pivotal to advancing digital lending solutions in today's market. Brankas, with its advanced open banking technology and deep understanding of API ecosystems, is the ideal partner as we strive to equip banks, financial institutions, fintechs, and other organizations with the tools they need to succeed in a rapidly evolving market."

This joint solution was first announced at the Open Finance Revolution 2024. Contact us today by visiting https://www.brankas.com/contact-us or emailing marketing@brankas.com to learn more about how LoanLink can transform your lending operations.

About Brankas

Brankas is a leading global open finance technology provider. We provide API-based solutions, data and payments solutions for financial service providers (like banks, lenders and e-wallets) and online businesses. Brankas partners with banks to build and manage their open finance infrastructure, producing APIs for real-time payments, identity and data, new account opening, remittances, and more. With Brankas' secure open banking technology, online businesses, fintech companies and digital banks can use Brankas APIs to create new digital experiences for their users.

About Boost Capital

Boost Capital is a global Fintech company which provides a white-labeled tech platform that allows Banks to onboard customers via popular chat platforms such as Facebook Messenger, Telegram, & Whatsapp.

Contact: Yiyang Teo, yiyang.teo@brank.as

source: Brankas

樂本健【年度感謝祭】維柏健及natural Factors全線2件7折► 了解詳情